Corporate Tax in Cyprus: A Strategic Guide for Real Estate Investors

24 April 2025

Cyprus is not only one of the most attractive destinations for real estate investments in Europe, it’s also one of the most tax-efficient.

At Square One, we guide our clients and investors through every step of their property journey, including strategic tax structuring.

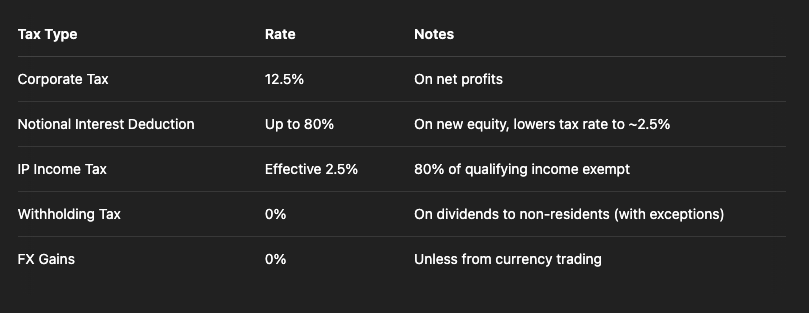

With a corporate tax rate of just 12.5%, a generous Notional Interest Deduction (NID) regime, and exemptions on Intellectual Property (IP) income, Cyprus offers distinct advantages for those investing through local companies.

Why Use a Cyprus Company for Real Estate Investment

Establishing a Cyprus company to purchase or manage real estate enables investors to benefit from a wide range of tax advantages.

These include a low 12.5% corporate tax rate, full deductibility of business expenses, access to Notional Interest Deduction (which can reduce effective tax rates to around 2.5%), and a favourable dividend regime for non-domiciled shareholders.

Understanding the 12.5% Corporate Tax Rate

Cyprus corporate tax is levied on net taxable profits.

These include income from rentals, property sales, and development profits, after deducting allowable business expenses such as loan interest, legal fees, maintenance, and depreciation.

Example: A Cyprus company earns €36,000 in gross rental income.

After deducting €20,000 in expenses, the net profit is €16,000. The company pays 12.5% corporate tax on the profit—€2,000.

When Is Corporate Tax Preferable

Using a company structure is often more efficient if you plan to acquire or manage multiple properties, reinvest profits rather than withdraw them annually, bring in co-investors, or require legal asset protection.

A company is also useful for non-EU investors looking to centralise their property holdings under one tax-optimised jurisdiction.

Notional Interest Deduction (NID)

Cyprus offers NID to incentivise equity funding. Investors injecting new equity into their Cyprus company can deduct a notional interest expense from their profits.

The deduction can be as high as 80% of the taxable income, reducing the effective tax rate to approximately 2.5%. This makes NID particularly valuable in real estate acquisitions where large capital inputs are involved.

Intellectual Property (IP) Income

If a real estate investment business develops branded assets, platforms, or licensed technology, it can benefit from Cyprus’s IP tax regime.

Under this regime, 80% of qualifying income from IP is exempt from tax, bringing the effective tax rate down to 2.5%.

The IP regime is aligned with OECD’s BEPS framework and is suitable for companies holding digital assets, booking engines, or property marketing software.

Additional Tax Benefits of Using a Company

Cyprus companies also benefit from:

- 0% capital gains tax on securities, such as shares and bonds (unless the company owns Cypriot property directly)

- No withholding tax on dividends or interest paid to non-residents

- Tax-free foreign exchange gains (unless part of active trading)

- Exemption from taxation on income from foreign permanent establishments

- Access to Cyprus’s double tax treaties network (over 60 countries)

When to Use a Company vs Personal Ownership

Use a company when:

- Managing multiple properties or development projects

- Planning to reinvest rental or sale profits

- Partnering with other investors under a corporate structure

- Seeking asset protection and estate planning tools

Hold property personally when:

- Purchasing a primary residence

- Qualifying for the reduced 5% VAT rate (available only to individuals using the property as their main home)

- Planning long-term ownership with minimal income generation

Conclusion: Cyprus Corporate Tax as a Real Estate Strategy

Cyprus offers one of Europe’s most business-friendly tax environments, and real estate investors can benefit significantly by holding property through a local company.

With low base tax, generous deductions, and zero withholding on international transfers, the advantages of incorporating are clear for those seeking scalable, international investment structures.

As always, consult a local tax advisor to ensure your strategy aligns with both your investment goals and the latest legal framework.

To learn more about setting up your property investment through a Cyprus company, contact us or explore our latest development opportunities tailored for investors.

Disclaimer

This article is provided for general information purposes only and does not constitute legal or tax advice. Always consult a licensed tax advisor for personalised guidance.